Fast and Flexible Funding for Your Business

Business funding solutions catered for your size and industry.

Get business funding as soon as tomorrow

Get your funds approved within minutes

Running a business is hard work. Every business owner has been faced with unforeseen events taking place and unanticipated expenses that arise every now and again.

When that happens, it is crucial that your business has flexible and accessible funding support.

Choice is dedicated to helping you get quick and secure funding with our streamlined 3-step application process.

Dedicated to supporting your business

Designed to offer you quick and affordable business loans, we understand the importance of having access to fast and secured capital.

With our streamlined application process, money can be in our account as soon as tomorrow.

A faster way to get pre-qualified

Simple 3-step application process

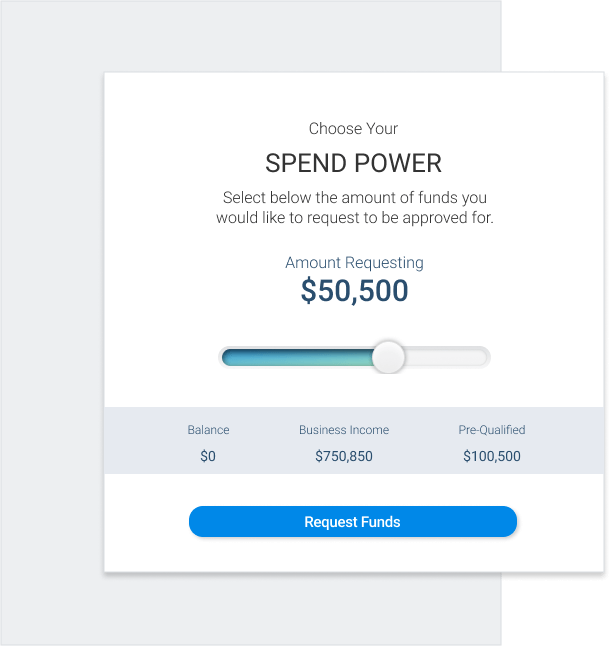

Choose your spending power

Work with our experienced funding team to define your financial needs.

Select reasons for funds

Select the solution that best suits for your business from our comprehensive list lending institutions.

Seamless banking integration

Loans can be finalized and processed in a single day. You can receive your funds within 24 hours.

Secured loans that keep your business running

Our merchant cash advance programs are designed to work through your credit card sales in the business.

Payments adjust based on your daily credit card volume. A $5,000 minimum in credit card sales a month is all that is needed to qualify! You can borrow as little as $5,000 and up to $500,000.

How Does It Work?

A merchant cash advance is when a lender buys a fixed percentage of your future credit card sales and supplies you the money, minus rates, ahead of time. The program is built so that you fulfill your advance with daily sales until the the advance is paid off in full. These types of advances may be the best fit if your sales and volume fluctuate or if you find that seasonality effects your business, seeing as how it parallels with your cash flow.

We’ll cater our loans to your needs

Full business funding support, regardless of your industry

Small business loans are structured with a fixed payback term, which is why they are so appealing to most business owners. This means there is a definitive maturity date when payments will cease and the loan is considered fully paid off.

The business owner also knows exactly how much is deducted based on the loan terms, which are clearly defined at the beginning of the lending process. This means no surprises! Typically small business loans are the most common type of funding applied for. Often times companies apply for SBA (Small Business Administration) loans, and due to high bank standards such as sub par credit scores or other small factors, businesses are turned down.

Specific, personalized, and exclusive

Our experts at Choice are here to assist you with any financial issues and offer support throughout your entire funding journey.

We understand that every business is different. That’s why we’ll adapt our funding solutions to fit your unique needs and requirements.

Repayment processes that put your worries to rest

Repay automatically at your own pace

Once you’ve taken out a loan, we’ve got a convenient repayment mechanism in place that will allow you to repay your loan at your own pace by deducting payment from your credit card sales.

Let us make things easier for you

Our split batch system allows you to repay your loan gradually with a small percentage of your sales.

If more than 50% is paid back and your sales start to increase, another withdrawal can be made.